Merchant Cash Advance

Get funding to increase cashflow from your sales revenue

Get Funds Fast!

History Required

Monthly Revenue Advance

Live & Funding

Supporting Lending in

the UK, Europe and USA

Need Cash Fast for Your Business?

Grow Your Business with a Cash Advance That Works for You!

With Merchant Cash Advance Funding, you get the money you need now and repay through a small percentage of your future sales. No complex loans. No long waits. Just quick, flexible funding to keep your business moving!

Get Funded. Fast!

- Borrow from £3,000 to £1 million*

- 3 months trading history

- 98% Approval rates*

- Get funds same day*

Merchant Cash Advances are ideal for small to medium businesses with steady credit card sales — including restaurants, retail shops, salons, and service providers. If your business needs quick capital without the limitations of traditional loans, this could be the perfect fit.

- Use funds your way – Inventory, payroll, renovations, marketing, or emergencies

- Pay VAT or Tax – A good solution for short-term cashflow management

- Funding start ups –Get much needed capital for your new business venture

Get the funds your business needs - Fast!

Need fast cash flow? We’ve got you covered...

Get up 2 million in funding for your business with no interest rates just a fixed affordable fee*

- No interest, just a fixed monthly fee*

- Excellent customer support

- Clear, transparent pricing

- Simple application process

Business use cases...

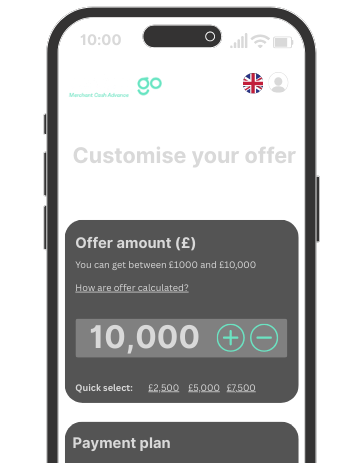

Flexible repayments

Pay back your advance automatically from your sales

You agree to a deduction from your sales and a repayment term from the outset. No interest fees, clear transparent fees.*

- Flexible terms

- No interest fees

- Flexible top ups

Get the funds your business needs - Fast!

You’ll only pay it back as your customers pay you, which makes it one of the most flexible options out there. Plus, the application process is quick (less than 10 minutes) with no hidden fees!

What is a Merchant Cash Advance?

How do I qualify for an advance?

• You have revenue that derives from card payments.

• Your business has a monthly turnover of at least £/€5,000+ monthly turnover

•You have over 3 months of trading history

• Max 2x monthly revenue advance sizes

How much can I borrow and what is the duration of the advance?

Min £/€ 5,000 – Max £/€ 1,000,000 loan amounts

• 1 – 18 months advance length

How long does it take to receive the funds?

In as little as 24 – 48 hours! Your dedicated account manager will guide you through this process

What information will you need?

3-12 months bank statements • Director and beneficial owner information

How do I get started?

Simply complete the enquiry form below, tell us how much you need to borrow and we’ll send you a personalised quotation.

*Eligibility criteria will apply. Business must be trading for 3 months or more, with a minimum of £3,000 in card transactions per month. All Cash Advance and Loan Advance applications are processed by our dedicated provider, YouLend Limited T/A YouLend. The funding offer is not connected to the funding offered by the UK Government